Custom Report for Tax Information¶

When income tax season comes, you may have volunteers request a report showing the number of times they volunteered during the year so they can deduct their mileage on their tax returns.

If you only have a few volunteers who want a report, you can just tag their record (or records) and run a report such as the Volunteer Service Details (stock) report.

If most of your volunteers will need a report, you may want to run a report for all of your volunteers at once. Then you can just print out the page(s) of the report that apply to the volunteer if a volunteer asks for the printout.

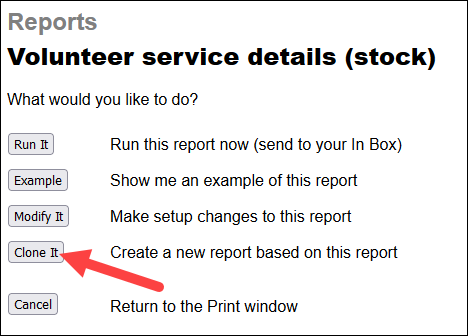

- Choose Reports from the menu.

- Expand Service Details.

- Select Volunteer service details (stock).

-

Click the Clone It button.

-

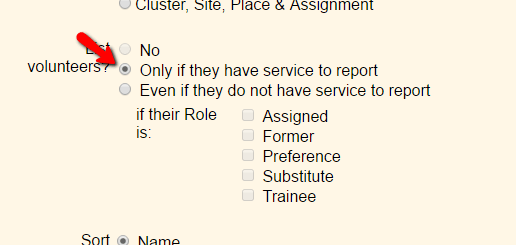

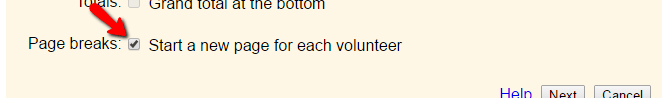

On the Options tab, change List volunteers? to Only if they have service to report if you do not want a page for volunteers who did not have any service recorded during the year. At the bottom, check the box by Page breaks so each volunteer's information will be on separate pages of the PDF.

-

On the Fields tab, you can adjust which fields of information will show. For example, you can remove the Merit Hours field. Additionally, if you've made Service Measures for tracking mileage or visits you can add them to the report.

- On the Page Design tab, you can change the title of the report and change the report's format if you'd like.

-

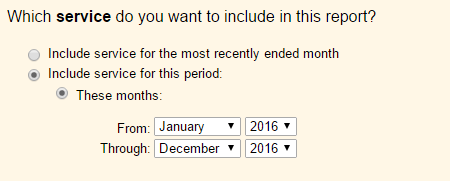

On the Include tab, select Include service for this period and These months. Then select January through December of the year you're running the report for. You can optionally choose to run the report for just a certain group of volunteers, such as just volunteers with the Active Status.

-

On the Save tab, give the report a name such as

Mileage ReportorTax Deduction Reportso you can find it again next year when you need it. - Click the Save and Run button to start the report.

- When the Include tab appears again, click the Run Now button.